The Facts About Hsmb Advisory Llc Revealed

The Facts About Hsmb Advisory Llc Revealed

Blog Article

A Biased View of Hsmb Advisory Llc

Table of ContentsThe Best Strategy To Use For Hsmb Advisory LlcNot known Factual Statements About Hsmb Advisory Llc Hsmb Advisory Llc - An Overview4 Easy Facts About Hsmb Advisory Llc ShownThe 9-Second Trick For Hsmb Advisory Llc3 Easy Facts About Hsmb Advisory Llc Explained

Ford states to steer clear of "cash value or irreversible" life insurance policy, which is even more of a financial investment than an insurance policy. "Those are really complicated, included high compensations, and 9 out of 10 individuals don't need them. They're oversold due to the fact that insurance policy representatives make the largest compensations on these," he states.

Handicap insurance can be costly, nevertheless. And for those that choose for long-term care insurance coverage, this plan may make impairment insurance policy unnecessary. Read a lot more regarding long-lasting treatment insurance policy and whether it's appropriate for you in the following area. Long-lasting treatment insurance coverage can help spend for expenditures connected with long-lasting care as we age.

Our Hsmb Advisory Llc Statements

If you have a chronic health and wellness issue, this kind of insurance coverage could wind up being crucial (Insurance Advise). Don't allow it emphasize you or your bank account early in lifeit's normally best to take out a plan in your 50s or 60s with the expectancy that you won't be using it until your 70s or later on.

If you're a small-business proprietor, think about securing your livelihood by purchasing company insurance coverage. In case of a disaster-related closure or duration of restoring, organization insurance coverage can cover your income loss. Think about if a substantial weather condition occasion influenced your store or manufacturing facilityhow would that affect your revenue? And for how long? According to a report by FEMA, between 4060% of small services never ever reopen their doors adhering to a calamity.

And also, using insurance coverage can often set you back even more than it saves in the lengthy run. As an example, if you obtain a contribute your windshield, you might take into consideration covering the fixing expenditure with your emergency situation cost savings as opposed to your vehicle insurance policy. Why? Because using your vehicle insurance policy can create your monthly costs to increase.

The 8-Second Trick For Hsmb Advisory Llc

Share these tips to shield enjoyed ones from being both underinsured and overinsuredand talk to a trusted professional when required. (https://www.viki.com/collections/3896580l)

Insurance coverage that is purchased by a private for single-person coverage or coverage of a household. The specific pays the costs, instead of employer-based medical insurance where the employer often pays a share of the premium. Individuals might buy and purchase insurance coverage from any plans readily available in the person's geographical region.

Individuals and households may qualify for monetary help to lower the price of insurance policy costs and out-of-pocket expenses, yet just when signing up with Attach for Wellness Colorado. If you experience particular changes in your life,, you are eligible for a 60-day duration of time where you can enroll in an individual plan, even if it is outside of the yearly open registration period of Nov.

15.

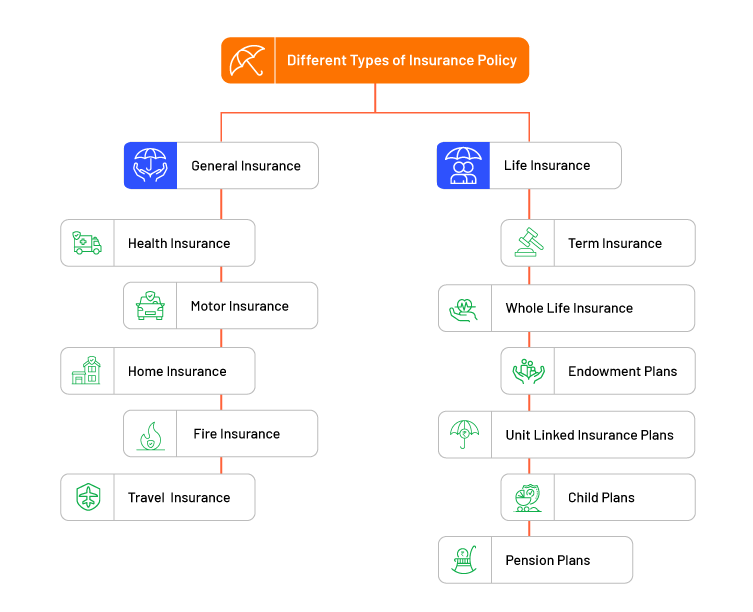

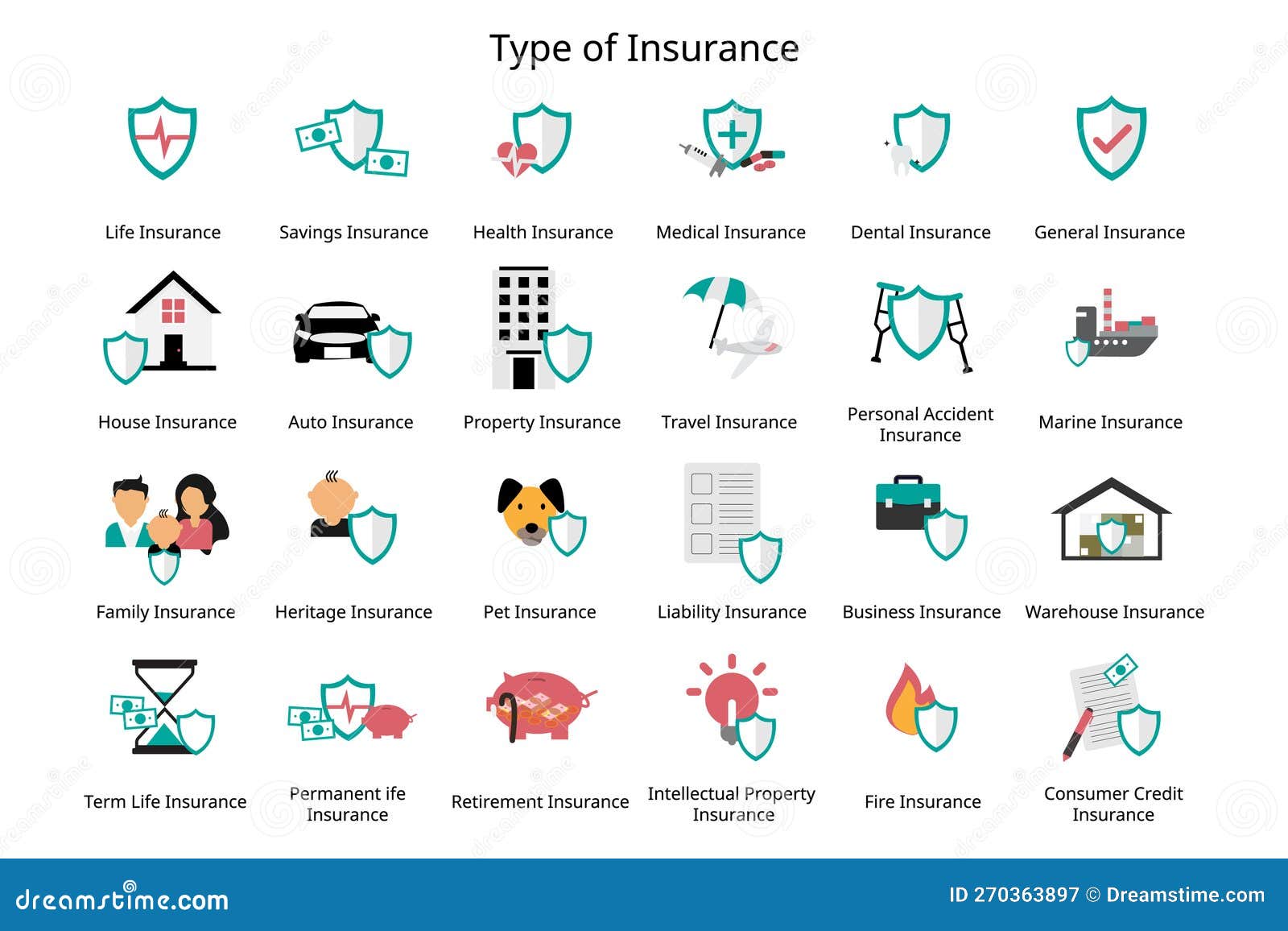

It may appear basic but understanding insurance coverage kinds can additionally be perplexing. Much of this complication originates from the insurance policy industry's ongoing objective to create tailored insurance coverage for insurance holders. In creating versatile plans, there are a variety to select fromand every one of those insurance coverage kinds can make it difficult to recognize what a certain policy is and does.

The 6-Minute Rule for Hsmb Advisory Llc

The most effective place to begin is to speak about pop over to this web-site the distinction in between the 2 sorts of fundamental life insurance coverage: term life insurance policy and long-term life insurance. Term life insurance policy is life insurance coverage that is just energetic for a time duration. If you die throughout this period, the individual or people you have actually named as recipients may obtain the cash payment of the plan.

Many term life insurance plans allow you transform them to a whole life insurance coverage plan, so you do not shed coverage. Normally, term life insurance policy plan costs payments (what you pay monthly or year right into your plan) are not locked in at the time of purchase, so every five or 10 years you possess the policy, your premiums can increase.

They additionally tend to be more affordable total than whole life, unless you purchase a whole life insurance policy plan when you're young. There are additionally a couple of variations on term life insurance. One, called team term life insurance policy, is common among insurance policy options you may have access to with your employer.

A Biased View of Hsmb Advisory Llc

An additional variant that you may have access to with your company is additional life insurance coverage., or interment insuranceadditional protection that can aid your household in situation something unforeseen happens to you.

Irreversible life insurance coverage just refers to any type of life insurance plan that doesn't end.

Report this page